GASB Reporting Services

GASB 75 reports for districts and county offices that offer other postemployment benefits (for example, postretirement healthcare).

GASB 73 reports for districts and county offices that offer pension plans that are not administered through trusts.

GASB 68 reports for districts and county offices that offer pension plans that are administered through trusts.

The GASB Reporting program provides:

- Full valuation and interim disclosure reports for single employer and agent employer plans.

- Proportionate share calculations for cost-sharing multiple-employer Plans (PERS, STRS).

GASB 75 Reporting

GASB Statement No. 75 is specific to postemployment benefits other than pensions (other postemployment benefits or OPEB). GASB 75 replaced GASB Statement No. 45 for fiscal years beginning after June 15, 2017. Medical, dental and vision health benefits for retirees are the most common form of OPEB benefits provided by public agencies.

GASB 75 compliance requires employers to report required supplementary information, including a net OPEB liability and an OPEB expense, on their annual comprehensive financial report.

Calculations are made by a certified Actuary in a GASB 75 actuarial report:

- Actuarial valuations are required every two years. An actuarial valuation provides a best estimate of actuarial liabilities at a particular point in time. Future liabilities are determined by applying a set of actuarial assumptions to project the occurrence, amount and timing of benefits that will become payable according to the current benefit provisions. The actuarial report involves an extensive analysis of the census data, plan provisions, claims cost and financial data.

- The actuarial report involves an extensive analysis of the census data, benefit provisions, projected claims cost (implicit rate subsidy) and financial data. The report includes important financial information for long-term budgeting including recommended contribution amounts (via a qualified trust) and long-term benefit payout projections.

- Calculations are updated between valuations in a disclosure or “roll forward” report. The OPEB liability is updated using roll-forward techniques prescribed by GASB to reflect changes in the discount rate, employer contributions, and fiduciary net position (assets in an irrevocable OPEB Trust).

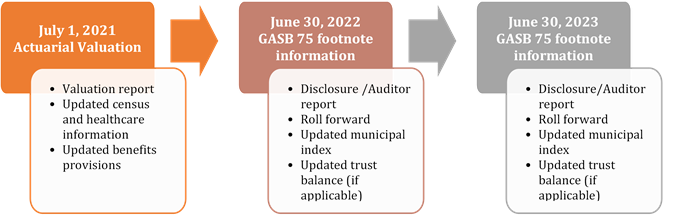

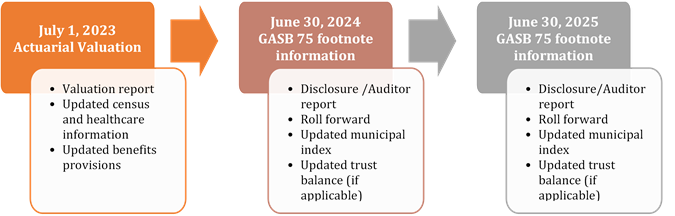

To comply with GASB 75 requirements, plans generally follow a two-year reporting cycle for their actuarial valuations. The cycle repeats every two years, provided the plan does not experience significant changes that would substantially alter the comparison between years.

Figure 1: A four-year example of GASB 75 reporting for a plan.

GASB 73 Reporting

GASB Statement No. 73 is specific to single employer pension benefits that are not administered through trusts.

Pensions include retirement income and postemployment benefits other than retirement income (cash-in-lieu, death benefits, disability benefits) that are provided through a pension plan.

GASB 73 requires employers to report required supplementary information like GASB 75 (see above).

GASB 68 Reporting

GASB Statement No. 68 is specific to pension benefits that are administered through trusts.

- Single employer and agent employer plans require full valuation and interim disclosure reports like those described for GASB 75 above.

- Cost-sharing multiple-employer plans require disclosure of the employer’s proportionate share of the net liability and pension expense. Proportionate shares are determined from information published for corresponding multiple-employer Plan (PERS, STRS).

For information about how CSBA can help your district with GASB reporting and compliance, contact Nicole Delos Reyes